Investor Education > Investment Basics > Timing the Market

INVESTMENT TRAPS

It's easy to fall into market traps. Knowledge is power so here's what you can now avoid.

Procrastinating

Many people hesitate to start investing because they don’t believe it’s ever the right time. However the best time to invest is now because the longer your investments have to grow the better the results.

By starting small and using a strategy like making regular investments, you can benefit from the exponential power of compound interest. Many fund managers provide regular investment options starting from $100 per month.

Timing the market

Many investors try to time the market to predict the best time to invest but shares are known for their volatile behaviour. This makes perfectly timing an investment almost impossible and usually not recommended by fund managers.

There is a clear need to understand the difference between timing the market and time in the market. Time in the market is an important aspect of investing.

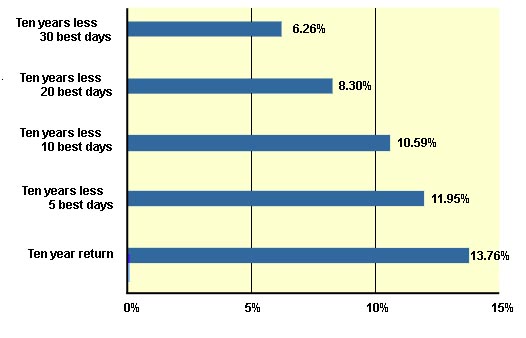

The time in the market theory states that the timing of an investment is not relevant for long term investments. It is the time frame of an investment that counts, because over time the volatility of the market will smooth out. Though it’s arguable that by investing at the “right moment” can be profitable, investors don’t often consider the opportunity cost of waiting for that “right moment”. While you’re waiting, you could be missing out on some of the investment days. The effect of waiting for the right moment to invest is illustrated in the following graph. This graph shows the percentage of return that an investor is missing out on depending on the amount of missed days.

Typically what counts is time in the market. When reading a product disclosure statement, an investment time frame is usually suggested. Investment time frames gives you an indication of how long the investment should be held for in order to enjoy higher returns. For example an investment horizon of 5 or more years is commonly suggested for shares, this is because in the short term shares are volatile but they recover in the longer term. Whilst cash and fixed interest investments attract shorter suggested time frames because they provide relatively stable returns in the short term.

Living in the past

In deciding on what to invest, many investors will decide to go with the fund or asset class that had the best performance last year. When switching investments can be made with little or no cost, many investors will move their investments in order to chase returns.

It’s important to keep performance figures in perspective. Over the past 20 years, of each asset class that had the highest return each year, the feat of the same asset class repeating the highest return on the next year only occurred twice. Past performance is not a reliable indicator of future performance or returns.

So instead of trying to keep up with the best performing funds of today, the better strategy is to invest with the big picture in mind. What are your goals, objectives and needs? Choose an asset allocation and investment strategy that suits your goals and benefit from ‘time in the market’ by sticking to it.